Printable 8962 Tax Form with Instructions

IRS 8962 Form: Premium Tax Credit Guide for 2023

The IRS Form 8962 is something you need to know about. It ties in with your Health Insurance. It helps determine your yearly tax credit on health coverage. In short, Form 8962 calculates how many credits you'll get back when you pay for insurance.

Are you finding it challenging? Does this document make your head spin? Don't sweat it. Our website, 8962-form-printable.net, is here to lift that weight off your shoulders. With the free printable 8962 form available, it removes the hustle of looking for this crucial document. Perhaps more importantly, we provide 2022 Form 8962 instructions in PDF and online. Our user-friendly guide makes filling out the blank template easy, clearing your path toward getting that valuable tax return. Why wait, then? Jump straight in, download Form 8962 from our excellent platform, and enjoy its benefits today.

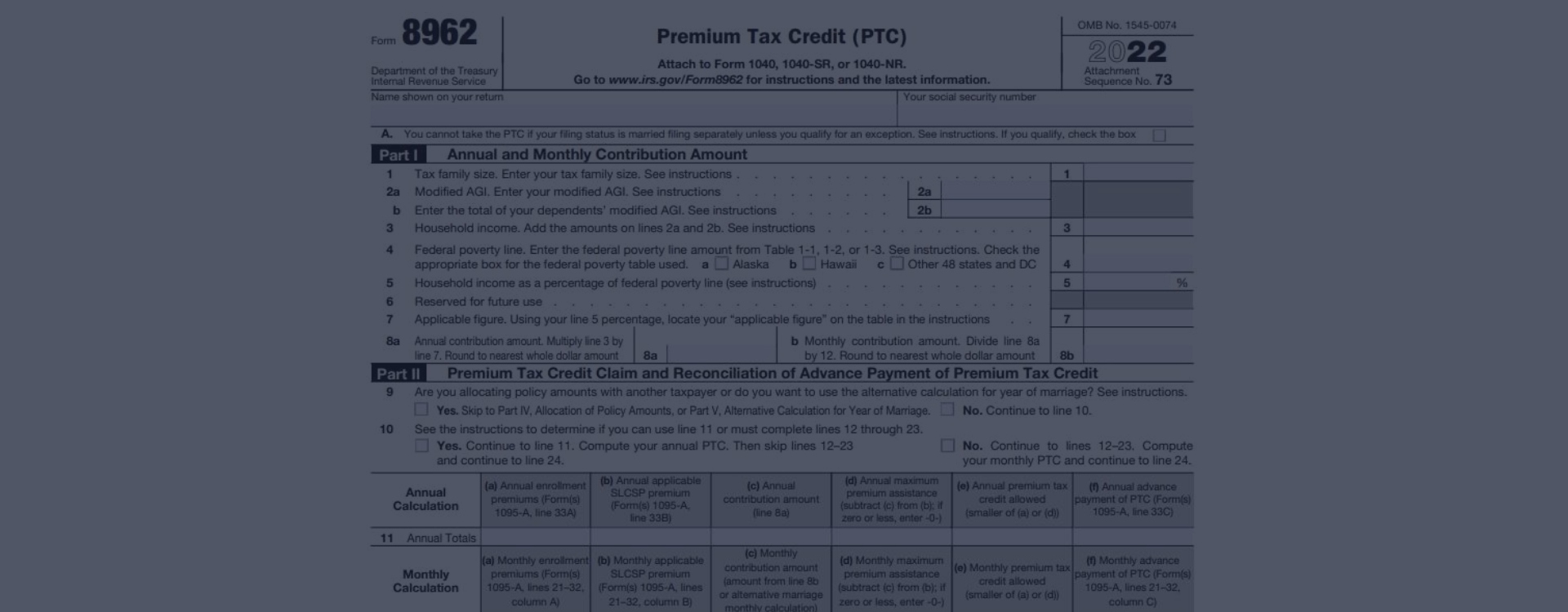

The Purpose of IRS Tax Form 8962 & Example of Use

Simply saying, you need the IRS printable form 8962 if you got help from the government to pay for health insurance. This document is for sorting out a Premium Tax Credit (consider it a special government discount!).

Now, let's think about Bob. Bob works in a shop and doesn't earn a lot. He was pleased when he got help to pay for his insurance plan. At the end of the year, Bob got a notice that said he's got the Premium Tax Credit. Now, Bob has to fill this out.

Now, let's think about Bob. Bob works in a shop and doesn't earn a lot. He was pleased when he got help to pay for his insurance plan. At the end of the year, Bob got a notice that said he's got the Premium Tax Credit. Now, Bob has to fill this out.

It sounds scary, but there are guidelines at hand. Bob takes a sample of the Form 8962 to see how it's done. He checks everything twice and sends it off. IRS Form 8962, Premium Tax Credit, helps Bob keep it fair with the government and get that well-deserved break on insurance!

The connection between Form 8962 and the W-2 form lies in the income information reported on both forms. The connection between Form 8962 and the printable W2 form lies in the income information. The W-2 provides details about the taxpayer's income, which is used in the MAGI calculation on Form 8962. This information is crucial for determining eligibility for the premium tax credit and the amount of the credit that the taxpayer may claim on their tax return.

Instructions to Fill Out Printable 8962 Tax Form

If you need to track your health credits, we got you covered! Simply print Form 8962 and fill it with the correct data. Filling a template isn't so hard if you follow these steps.

Penalties & Due Date

Be careful while filling the 8962 form printable for 2022, and double-check its correctness. Giving false info can lead to problems. Think of fines and penalties. It's like being late for school but worse. You don't want to deal with these types of problems. So, avoid them with timely and accurate filing! It's essential to file Form 8962 on time. The due date is the same as for your other tax returns - April 15!

The 8962 Printable Form: Key Takeaways

- Form 8962 is part of the IRS Income Tax Return and applies to individuals seeking the Premium Tax Credit (PTC). This type of government subsidy aims to make purchasing health insurance more accessible for low-income individuals and families.

- To be eligible for PTC, an active health insurance plan must be registered under the Health Insurance Marketplace in the specific tax year.

- If unsatisfied with the PTC initially received, usage of Form 8962 example can alter PTC as per new pay stubs or evident changes in annual income level.

Federal Tax Form 8962: Popular Questions

More about Form 8962 & Premium Tax Credit (PTC)

Please Note

This website (8962-form-printable.net) is an independent platform dedicated to providing information and resources specifically about the 8962 form, and it is not associated with the official creators, developers, or representatives of the form or its related services.